Wealthness Coach

Lean on decades of financial experience as our Wealthness Coaches help you find financial clarity and peace of mind.

Our #1 priority is YOU:

The Entrepreneur!

Since its founding in 2001, every decision has been guided by our mission to help individuals create the life they want to live, while protecting their loved ones and planning their financial legacy.

Our Motto: No Family Left Behind!

Offering access to a diverse portfolio of products and programs from multiple vendors, iCanElevateU helps guide individuals from where they are to where they want to be.

Start with the Financial Basics Program and grow from there to become an Expert on your finances so you leave a Legacy for those people and causes important to you.

Our platform is based on Financial Education first and foremost. An educated consumer makes better decisions on where money is placed. We are the Amazon of Financial Services. We connect you with one of 200 vendors that represent about 500 products. We design a financial plan specifically for YOUR needs. There are no fees to the client and no quotas to fill.

Safeguard Your Assets

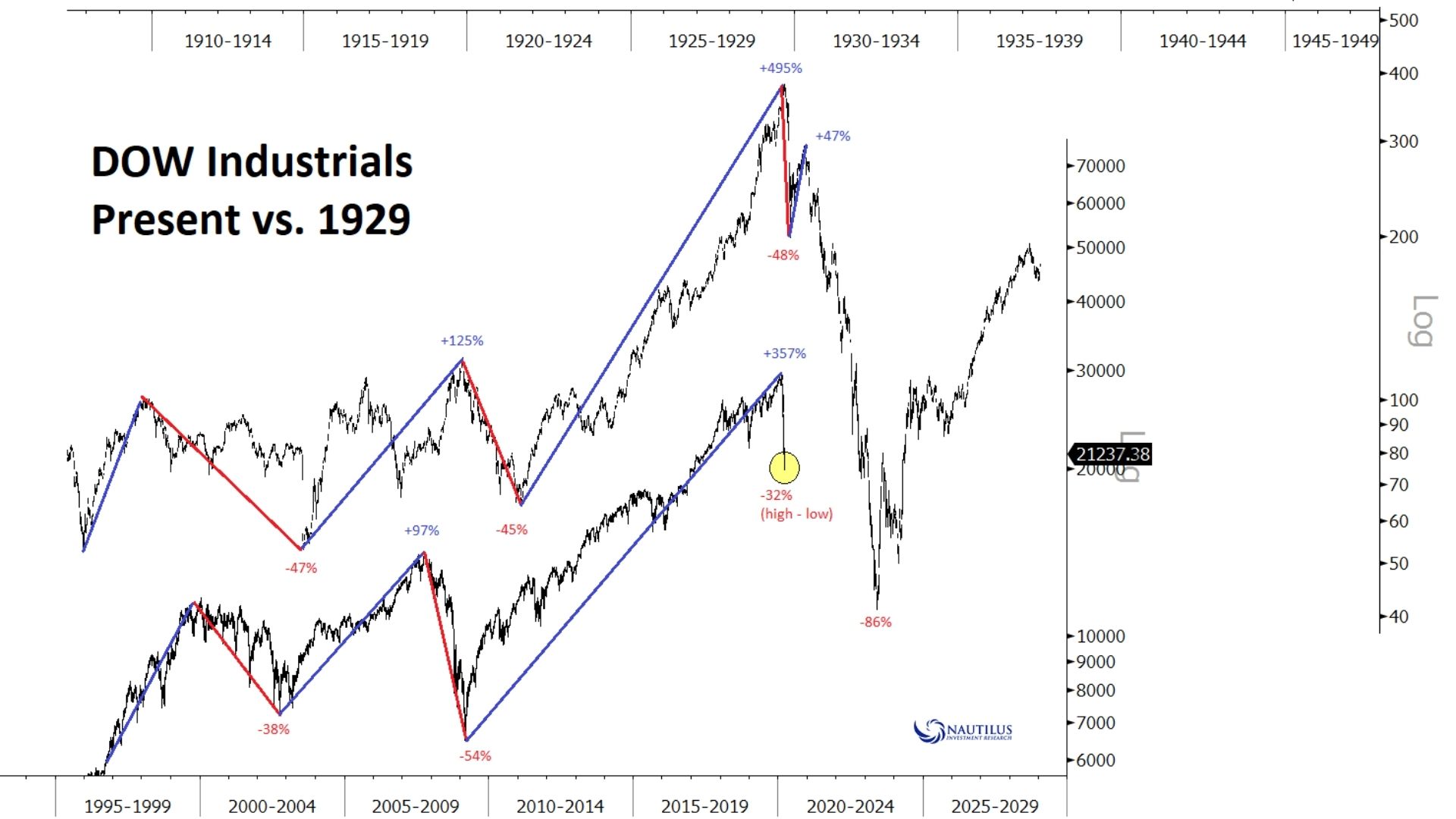

This is a comparison of the market pattern before the crash of 1929 to the market pattern from 1995 until today. Scary, right?

How much are you willing to risk if there is a market correction? How safe is YOUR hard-earned money?

We invite you to make an appointment for a Wealthness Checkup to ensure YOUR assets are protected.

Personalized Financial Strategies

A Financially Secure Future

Our Wealthness Coaches take time to understand your financial needs and goals and provides an actionable roadmap to financial security.

Invest Intelligently

Safeguard your friends and family with customized insurance packages designed to protect those closest to you.

Collaborative Financial Plan

Our Wealthness Coaches work collaboratively with your tax and legal advisors to create a personalized financial plan.

Student Loan Forgiveness

Student loan debt in our country is $1.7 trillion. How long does someone have to work to repay their college loans? Let us show you our Student Loan Forgiveness program. You may qualify to pay zero!

Debt Restructuring

We work with several vendors to help you restructure your debt. And, there is a program with AI (Artificial Intelligence) that will help you pay your debt and reduce your interest so you can save quicker!

Millionaire Kids

Let us show you how to start with your kids or grandkids so that when they retire they will be worth millions $$$. And that fund can pay for college, a wedding, a house, or whatever your kids need. And, it’s tax exempt!

Steps for Success

Step #1

Sign-Up for Wealthness Checkup

Sign-up for a Wealthness Checkup to receive an in-depth and comprehensive look at your current financial situation.

Step #2

Meet with a Wealthness Coach

After scheduling a Wealthness Checkup, meet online with one of our Wealthness Coaches to begin visualizing your financial roadmap.

Step #3

Start Saving Money

Lean on the expertise and suggestions from our Wealthness Coaches to begin saving money and investing intelligently.

Contact Info

For any inquiries, please schedule an appointment using the Calendly link provided below.